Benefits

Frederick County Public Schools (FCPS), the Insurance Council and the Board of Education strive to bring state of the art benefits to our employees and their families.

- CareFirst Disability Certification - Overage Dependent

- CareFirst Member Claim Form

- CVS Mail Service Order Form

- CVS Reimbursement Claim Form

- Delta Dental Claim Form

- Enrollment/Change Form

- MSRA Application for Membership

- MSRA Beneficiary Form

- MSRA Form 26 (used to purchase previous service from a private school or another county)

- MSRA Form 43 (allows you to get credit for prior military service)

- Davis Vision Claim Form

- Voluntary Life Insurance Application - Customer No. 260107

- WEX Reimbursement Claim Form

- WEX Benefits Recurring Dependent Care Request Form

- WEX Status Change Form

FMLA/Personal Disability Forms:

Monthly COBRA Rates FY 2025

| COBRA | Medical | Dental Standard | Dental Buy UP |

|---|---|---|---|

| Individual | $996.46 | $29.40 | $40.43 |

| +1 Dependent | $2,172.29 | $91.15 | $125.38 |

| Family | $2,291.86 | $100.86 | $138.70 |

*Qualified individuals are responsible for the entire premium for coverage up to 102% of the cost to the plan.

FCPS offers COBRA coverage to any employee or dependent who experiences any of the following qualifying life events:

- A covered employee’s death,

- A covered employee’s job loss or reduction in hours for reasons other than gross misconduct,

- A covered employee becoming entitled to Medicare,

- A covered employee’s divorce or legal separation, and

- A child’s loss of dependent status (and therefore coverage) under the plan.

The length of continuation coverage is determined by the type of qualifying event. A COBRA enrollment letter will be sent to any individual who experiences a qualifying event. If an employee is not actively enrolled in benefits at the time of the event they are not eligible for continuation coverage. COBRA coverage becomes effective the 1st of the month following the date of the qualifying event and can be canceled at any time.

For additional information about COBRA rules and guidelines, please visit https://www.dol.gov/general/topic/health-plans/cobra.

Alternate Forms of Coverage

Instead of enrolling in COBRA continuation coverage, there may be other more affordable coverage options for you and your family through the Health Insurance Marketplace, Medicaid, or other group health plan coverage options (such as a spouse’s plan) through what is called a “special enrollment period”. Some of these options may cost less than COBRA continuation coverage.

Please visit www.Healthcare.Gov for more information on group marketplace plans through your resident state.

See also Required Notices: COBRA

http://www.deltadentalins.com

(800) 932-0783

FCPS offers two dental plans administered by Delta Dental. One is a Standard plan with an annual limit of $1500 per person per plan year and one is a buy-up option plan with an annual limit of $2500 per person per plan year.

See Dental Plan Summary below for coverage details.

WEX Benefits

(866) 451-3399

Contact WEX Benefits

WEX Benefits Toolkit

It is the individuals responsibility to manage their FSA account through their email, WEX App or the above website which does not expire regardless of the status of the individual. The FSA Plan Document contains important information regarding the administration of this plan.

Election

WEX is the administrator of the Flexible Spending Accounts (FSAs), which allow an employee to contribute on a pretax basis to an account they can then use to pay for qualifying expenses. Once elected, you will not be able to change your annual FSA election unless a “qualifying life event” occurs.

Reimbursement

Throughout the Plan year you can submit for reimbursement for qualified medical and dependent care expenses in the following ways: fax (forms available at https://www.wexinc.com/solutions/benefits), email, online, or mobile application. Employees may also pay for their qualified medical expenses directly from their FSA with the WEX debit card. See the Summary Plan Description for further details. Expenses are “incurred” when the service has been provided. The reimbursement requirements will be listed on the reimbursement claim forms.

A Health Flexible Spending Account (FSA) allows you to get reimbursed for qualified medical expenses with pre-tax funds (see Section 213 D and Section 105 of the Internal Revenue Code for list of eligible expenses. You cannot use your FSA for expenses that have been paid by your medical insurance plan).

FSA Health maximum annual election for plan year 2024-2025: $3,200

Run-out Periods for Submitting Claims is as follows:

You must submit your claims for reimbursement to WEX per the schedule below timely or you can not be reimbursed per IRS guidelines.

| Run out period for active employees: | 90 days after plan year ends (last day to submit claim is Sept. 28) |

|

Run out period for terminated employees: |

90 days after your termination date |

Rollover

Under IRS regulations, employees may rollover $640 of their Health FSA funds from one plan year to the next. The rollover funds will be available to employees for one additional year. Any amount rolled over will not affect the election amount for the new Plan year. Any funds above the current rollover limit, left over after the 90 day runout period, will be forfeited.

The Dependent Care Flexible Spending Account (DCAP) allows you to be reimbursed for qualified dependent day-care expenses with pre-tax funds. The maximum annual election amount is $5000 (married filing jointly or head of household) or $2500 (married filing separately). To be eligible for reimbursement you will need to provide a statement from the service provider with the following information: name, address, taxpayer identification number (in most cases), and incurred expense amount. Please see the Summary Plan Description for dependent eligibility requirements.

At the end of the plan year, any unspent money in a Dependent Care FSA is forfeited.

Run-out Periods for Submitting Claims is as follows:

| Run out period for active employees: | 90 days after plan year ends (last day to submit claim is Sept. 28) |

| Run out period for terminated employees: | 90 days after your termination date |

What is a Flexible Spending Account (FSA)?

Flexible Spending is an employer sponsored program that allows you to set aside money pre-tax to use for certain IRS eligible expenses. The Medical FSA covers not only medical expenses, but also dental and vision services.

How does an FSA work?

During the open enrollment period with your employer, you will make an election for the amount you want contributed to your FSA. That annual amount will be divided equally over your yearly pay schedule, and deductions will be made pre-tax from each pay check and deposited to that account. As you incur expenses, you will submit for reimbursement from your account, either with a paper claim (Reimbursement Claim Form) or with the WEX debit card.

What are the advantages to having an FSA?

When you participate in the Flexible Spending program, your eligible expenses are paid for with tax-free money. Also, as the contributions are withheld from your paycheck pre-tax, it lowers your taxable income, meaning you pay less in taxes, and take more money home.

What are considered eligible expenses?

There are 3 things to consider as you determine whether an expense is eligible for reimbursement from your Medical FSA - services, service dates, and eligible dependents.

Services - Eligible medical expenses are defined by IRS Code §213(d) and must not be excluded by the plan documents. In order to qualify for reimbursement, the expense must diagnose, cure, mitigate, treat, or prevent disease, or affect a structure or function of the body. Expenses aimed at maintaining general health or improving a person’s appearance (cosmetic procedures), are not considered eligible expenses.

Service Dates - In order to be eligible for reimbursement, services must be provided/incurred during the time that you are covered and active under the plan. The IRS is concerned with the actual date of service, not the date of payment.

Eligible Dependents - Coverage for a Medical FSA is extended to the employee, the employee’s spouse, and the employee’s child who is under age 26 or someone else who is a qualified tax dependent of the employee.

When can I enroll?

You may enroll in the plan during your employer’s open enrollment period prior to the start of the plan year. You may also enroll mid-year if you are a newly hired employee, or if you have a qualified Status Change Event as outlined in the Summary Plan Description.

Can I make changes to my account mid-year?

Once you make your election during the enrollment period, it cannot be changed or canceled during the plan year, it is irrevocable. Exceptions to the irrevocability rule are allowed mid-year with a qualified Status Change Event such as a marriage, divorce, birth, adoption, death, etc. The election changes must be consistent with the status change.

What if my spouse has a Health Savings Account?

If your spouse is participating in a Health Savings Account (HSA), participation in this FSA may disqualify them from further contributions to that HSA.

What happens to money left in the account at the end of the plan year?

Under IRS regulations, employees are able to rollover up to $640 of their Health FSA funds from one plan year into the next. This will allow participants an additional 12 months to spend the remaining balance. Funds that are rolled over will not affect election amounts for the new plan year. A Run-out period will still be applicable, allowing you time to submit reimbursement claims for expenses incurred prior to the end of the plan year. Rollover does not apply to the Dependent Care FSA.

Do I have to wait for the money to be deposited before requesting reimbursement?

With a Medical FSA, you do not have to wait for the deposits to be made before requesting reimbursement. Your full annual election amount is available to you on the first day of the plan year.

What information do I need for reimbursement?

In order to verify the eligibility of an expense, we need a third party statement indicating the provider’s name and contact information, the patient, the date of service (not the date of payment), a description of services rendered, and your portion of the expense. You should also retain a copy of the statement for your records.

How do I submit a reimbursement claim and when can I expect payment?

Reimbursement claims may be submitted electronically with the "Online Claims Entry" option on your account through www.wexinc.com. Reimbursements may also be submitted with a printed reimbursement claim form and sent to our office via email, fax or postal service. Reimbursement claims will be processed daily.

Where can I find out my account information and balance?

As a participant, you will have access to a secure online account through www.wexinc.com. Here you will be able to view your account history and balance, submit reimbursement claims electronically, view eligible expenses lists, print various forms and documents, and much more. You will be provided the online registration information after enrollment.

WEX Debit Card

What is the WEX debit card?

The WEX debit card is a Visa® debit card that offers you direct access to your FSA funds.

How does it work?

You may swipe your WEX card as you would any other debit card at a qualified medical merchant. The merchant must accept Visa® as a form of payment. The funds will be debited from your Flexible Spending Account and paid directly to the service provider.

Where can I use it?

The use of the WEX card is limited to providers with a qualified medical Merchant Category Code (MCC). These include doctor’s offices, hospitals, pharmacies, dental offices, and vision clinics. The card will not be accepted at an ATM or for cash back on a purchase.

What if I lose my card?

From your account on www.wexinc.com you have the capabilities to report your WEX debit card as lost or stolen and to order a replacement card.

Can I have additional cards?

All enrollees will automatically be issued one debit card at the start of participation in flexible spending. Any additional or replacement cards my be ordered through WEX.

Will I need to send in any paper work?

Under the IRS regulations, we are required to verify the eligibility of every expense, whether paid with a reimbursement claim or the WEX debit card. There are various check-point systems in place to greatly reduce the amount of documentation you will be required to submit to our office as you use the debit card, but it does not eliminate the need for paper work entirely. The information requested will be the same as that of a reimbursement claim (see What information do I need for reimbursement? above). For each card swipe, you will receive automatic email notifications. These notifications will inform you of the status of the transaction, and whether or not additional information/documentation is being requested.

What happens if a card payment is ineligible?

If all or a portion of your WEX debit card transaction is deemed ineligible, you will be required to pay back the ineligible amount to your flex account. This can be done in a variety of ways and our staff will help you find the option best suited for you. Please be aware that while there is money due on your account, your debit card will be temporarily suspended until all transactions are either paid back or resolved.

Quick Guide for Leave of Absence and FMLA Regarding Your FSA

How does a Leave of Absence/FMLA impact my Cafeteria 125 Flexible Spending Plan?

When you know that you will be going on a leave of absence or FMLA, it is important that you reach out to your HR Benefits Team at 301-644-5093 as soon as possible to discuss your various options regarding your Medical, and or Dependent Care Flexible Spending Account(s) and your contributions, as it could impact your access of funds while on leave.

What are the funding options provided by my employer when taking an unpaid leave of absence or FMLA?

Whether you are going on a paid or unpaid leave of absence or FMLA, the funding options for your employer are the same:

Prefund your Medical and or Dependent Care Accounts for the period of time that you will be on leave. This option will allow you to continue to receive and pay for services while you are on leave.

Make catch-up contributions upon returning from leave. Please note that this option would not allow you to have access to your Medical and or Dependent Care Accounts while you are on leave. However, upon your return, payroll will increase your contributions to help you “catch-up” on missed contributions while you were on leave. Once catch-up contributions have begun, you will be able to be reimbursed retroactively for eligible services received during your leave of absence or FMLA.

For a more detailed description, please refer to the Summary Plan Description.

200 Park Avenue

New York, NY 10166

855-229-7306

Life, Medical Underwriting Questions, Short Term Disability

When calling MetLife, provide customer number 260107 for FCPS identification.

Employer Provided Benefits

Employee Life Insurance & Accidental Death and Dismemberment (AD&D)

FCPS offers group term life insurance including accidental death and dismemberment coverage as a part of the benefit package to eligible employees at no cost. The life policy is equal to twice the base annual earnings, rounded to the nearest $1,000.

If you separate active service with Frederick County Public Schools, you are eligible for Portability and Conversion options as it relates to the life insurance(s) amount lost as a result of your new status; leave of absence, resignation or retirement. You will find information from MetLife below for your review. If you wish to pursue Portability or Conversion options, please reach out to Benefits.FCPS@fcps.org within 31 days of your loss of coverage for further instructions.

Please contact Christine Hobble at (240) 586-8012 to submit a life insurance claim.

Designate a Beneficiary

To change your beneficiary, log into Employee Self Service.

Voluntary Benefits

Employees may elect additional life coverage for themselves, and their spouse and children. New employees may choose this coverage with no medical underwriting provided they enroll within 31 days of the date they become eligible for coverage. If you do not enroll during the initial period of eligibility, you may enroll at any time but may be subject to an evidence of insurability process.

Additional Life Resources

Short term disability coverage provides a weekly income benefit for employees who are unable to work due to a covered condition. New employees may elect short term disability with no medical underwriting requirement within 31 days of the date they become eligible for insurance with FCPS. Current FCPS employees who did not enroll within 31 days of the date they became eligible, may request enrollment by first, completing and submitting the Statement of Health document found in the 3rd bullet item in the following listing: instructions on submitting document are included. MetLife will notify the employer if the employee has been approved where enrollment and contributions will follow by our Benefits Team; enrollment will be effective the 1st of the month after this enrollment (or the 1st of the month if enrollment occurs on this day).

Additional Short Term Disability Resources

- Certificate

- Short-Term Disability Estimated Cost Calculator (Excel file)

- Statement of Health

- Privacy Information Privacy Notice | Pre Notice

- How to share Statement of Health with MetLife

- When can I enroll in insurance? When is insurance effective?

NEW HIRES may enroll within 30 days of hire date using Employee Self Service. If you were hired on the 1st of the month, your Medical and Dental coverage will go into effect on the same day. If you were hired on the 2nd- 31st, your Medical and Dental coverage will go into effect on the first of the next month. Please note you must elect the coverage through Employee Self Service.

CURRENT EMPLOYEES may enroll during Open Enrollment in May with the benefits effective July 1st OR within 30 days of a qualifying life event. An enrollment form and supporting documentation must be received within 30 days of the qualifying life event.

Open Enrollment information

- Who is eligible to enroll?

Benefited employees working 17.5 hours per week are eligible to participate in the employee group health and welfare plans. Your eligible dependents are as follows:

Eligible Dependents:

- Employee’s Legally married Spouse

- Eligible Employee’s child who is under age 26, including a natural child, stepchild, a legally adopted child, a child placed for adoption or a child for whom you or your Spouse are the legal guardian; or

- Unmarried, incapacitated Dependent children, age of twenty-six (26) (Limiting Age) and over will be eligible for coverage if:

- The Dependent child is chiefly dependent for support upon the employee (Subscriber) or the employee's Dependent spouse and this is verified via a current year tax return showing the Dependent child claimed as a dependent (income information may be redacted); and

- At the time of reaching the Limiting Age, is incapable of self-support because of mental or physical incapacity that started before the Dependent child attained the Limiting Age.

- The Subscriber provides proof of disability to medical carrier within thirty (30) days of enrollment opportunity, Qualified Life Event or within thirty (30) days of when coverage would otherwise terminate. Proof is shared using the medical insurance carrier’s form (CareFirst Disability Certification - Overage Dependent); record of approval must be on file with our carrier.

- How do I enroll in benefits?

Enrollment in benefits is through Employee Self Service for a newly hired employee and during open enrollment. An employee returning from a leave of absence or experiencing a qualifying life event may submit an enrollment change form to the benefits office within 30 days of the event.

- When is Open Enrollment?

Open Enrollment occurs each year in May for active employees. Changes made during open enrollment in May are effective July 1st, the start of the new plan year.

- Why is the period to enroll/ make changes limited?

Most of the benefits plans offered through FCPS are paid with pre-tax dollars. In exchange for that tax advantage, you legally cannot enroll in, cancel, or make changes to your spending account plans outside the annual Open Enrollment period, unless you experience one of the qualifying events described above.

FCPS follows the Internal Revenue Service Section 125 guidelines and requirements for pre-tax deductions. Therefore, the IRS limits when certain changes can be made or changed under a pre-tax plan(s).

- I am a New Hire, what benefits are available to me?

The FCPS benefit package includes:- Medical (including vision and prescription)

- Dental

- Group Life including Accidental Death and Dismemberment

- Short Term Disability

- Leave

- Employee Assistance Program

- Tuition Reimbursement

- Wellness benefits

- How does insurance coverage work when receiving summer pay?

Insurance premiums are not deducted from summer pay. A 10 and 11 month employee pays insurance premiums for the full fiscal year through their regular pay (20 pay periods for 10-month employees and 22 pay periods for 11-month employees). The premiums for July and August are paid when you return for the following school year.

- How do I get an Insurance card?

You will receive a CareFirst medical/vision card and CVS/CareMark prescription card by mail within 2-3 weeks of enrollment. Delta Dental does not mail insurance cards. You can contact Delta to request a card or create an online account at deltadentalins.com to print an insurance card.

- How do I enroll my newborn in coverage?

Within 30 days of birth, submit an enrollment change form to the Benefits Office.

- Do I need my newborn's birth certificate and social security number to enroll in coverage?

You can enroll your newborn in health coverage before you have their birth certificate or social security number. These items can be provided later once you receive them. Newborn’s must be enrolled in coverage within 30 days of birth.

- When do benefits end?

If your termination date is on the 1st of the month, your medical and dental coverage will end that same day. If your termination date falls between the 2nd and 31st, your coverage will continue through the last day of that month. For 10 or 11-month employees who resign over the summer and do not return for the following school year, coverage will terminate retroactively to July 1st.

Last day of employment, March 23rd (employed); last day of benefit coverage at active rate is March 31st.

Last day of employment (employed), March 31st; last day of benefit coverage at active rate is March 31st.

Leave accrual will cease on your resignation or termination date.

Life insurance and short-term disability coverage are dependent on your resignation or termination date and will end either on the 16th or the 1st of the following month.

Pension retirement termination will also depend on your resignation or termination date and will end either on the 16th or the 1st of the following month.

www.carefirst.com/frederick

Medical: 866-386-2043

Blue Vision Plus: 800-783-5602

FCPS offers a comprehensive medical plan that includes prescription and vision coverage.

Effective January 1, 2024, CareFirst members will access telehealth needs through CloseKnit. This will replace your App of CareFirst for telehealth. Please see the following information pieces for further information.

CareFirst Medical Plan

BlueChoice Advantage offers in- and out-of-network coverage and no referral is needed to see a specialist. Please refer to the CareFirst and the Vision Plan Summary below for coverage details.

Searching for provider? Call 1-866-386-2043 or visit www.carefirst.com/frederick.

Medical Links:

- Summary of Benefits

- Benefits Health Guide+

- Evidence of Coverage

- Summary of Benefits & Coverage (SBCs) See also: definitions of common insurance terms

Vision Links:

Active employees & Non-Medicare Retirees

(866) 260-4646

Medicare Eligible Only

(866) 785-5711

Note: The Public Health Emergency (COVID) ended on May 11, 2023; this ends the no-cost for Over The Counter COVID Tests.

CVS uses a formulary list of generics and preferred medications to keep your prescription copays at the lowest cost possible. To see a complete list of the approved formulary medications, please review under your plan on the appropriate CVS website.

The best tool for prescription information is found in the CVS website under the Check Drug Cost tool. When logged into your account, this tool provides detailed information on specific prescriptions such as cost and coverage. The formulary list, mentioned above, shares a footnote of the following: “Your specific prescription benefit plan design may not cover certain products or categories, regardless of their appearance in this document. For specific information, visit Caremark.com or contact a CVS Caremark Customer Care representative.” For this purpose, we recommend logging into Caremark.com and using the Check Drug Cost tool.

- Maintenance Choice Program - Mail Order Prescriptions – plan participants who take maintenance medications have the choice to purchase their 90-day supply from the mail order program or from a CVS/Pharmacy store and pay the same mail order copayment.

- Mandatory Generics – required when available as well as using the mandatory specialty pharmacy program or specialty prescription drugs. Recognizing that there are times when a patient cannot take a generic, FCPS has established a Formulary Exception Process. This process requires a member to try a number of generic drugs, under the direction of their physician. Should those generic drugs not be appropriate for the member’s condition, an exception for a brand drug/non-formulary drug can be approved for a limited time period. If you believe this applies, you or your physician may contact CVS Customer Service to begin the Formulary Exception Process. Customer Service: 1-866-260-4646

- Prior Authorization - Some medications require Prior Authorization (PA). If this applies to a medication that you have been prescribed, CVS will notify your physician of this requirement when your prescription is received. The prescribing physician will be asked to provide additional medical information to approve the prescription for you. Once this has been provided and evaluated by CVS, the prescription will be filled or your physician will receive specific information as to why the medication was denied. You will be mailed an explanation as to the denial of the medication which will include information on the appeal process.

- Caremark Mail Service Pharmacy

How were my covered options chosen?

There are often multiple medicines available to treat the same condition – either a generic medicine, brand-name medicine or both. These options have shown to be effective and safe, and they may even help you save money on your prescriptions. Our pharmacy staff has determined that your medicine has these types of options available. You and your doctor can determine the best covered option for you.

Why are generics becoming so popular?

The U.S. Food and Drug Administration (FDA) has approved more than 10,000 generic medicine options for brand-name medicines, so there is likely to be one available to help you obtain a lower-cost, effective treatment. Generic medications are available for common conditions such as high cholesterol, blood pressure, allergies, asthma, migraines, stomach acid, osteoporosis and others.

Are generics really that much cheaper?

Yes. In fact, many generics can cost up to 80 percent less than their brand-name counterparts. You can check your drug coverage and costs now to see how much you can save by choosing a generic medicine instead of a brand-name medicine. Generic medicines are less expensive because the original patent has expired, and other manufacturers can apply to the FDA to sell the generic version. With no investment costs and more competition among the generic manufacturers, the price of generics is kept down.

Research shows that individuals on average can save 30 to 80 percent by using generics. Your savings will vary based on your plan and/or drug prescribed. Source: Generic Pharmaceutical Association.

What if my doctor wants me to stay on my current medicine?

If your doctor thinks there is a clinical reason why one of these covered options won’t work for you, your doctor can call us toll-free at 1-800-294-5979 to request prior approval for your current medicine(s). Please remember that approvals are granted only in a limited number of cases, so it is best to talk to your doctor about choosing a covered option.

If the formulary excluded drug is approved, what tier does it pay at?

The drug will pay at a tier 3 non-preferred copay/coinsurance. If it is a multi-source brand drug, the “Member Pays the Difference” penalty may also apply.

Prior Authorization Frequently Asked Questions

Prior Authorization - Some medications require Prior Authorization (PA). If this applies to a medication that you have been prescribed, CVS will notify your physician of this requirement when your prescription is received. The prescribing physician will be asked to provide additional medical information to approve the prescription for you. Once this has been provided and evaluated by CVS, the prescription will be filled or your physician will receive specific information as to why the medication was denied. You will be mailed an explanation as to the denial of the medication which will include information on the appeal process.

Why is prior approval now required for my current medicine?

CVS Caremark is committed to helping you get the most effective medicines at the best price. Our pharmacy staff continually reviews medicines, products and prices for your plan sponsor. As part of this effort, some medicines on your drug list require prior approval by your doctor and our clinical staff.

What happens if I do not receive prior approval for my current medicine?

If your current medicine does not receive approval by your doctor and our clinical staff, you will pay the full price if you continue using it. Since approvals are granted only in a limited number of cases, you will want to talk to your doctor soon about choosing a covered option.

Will the PA team follow up with the member or doctor upon approval/denial of the exception request?

Yes, the member will receive a letter via mail and the doctor via fax.

Can the member appeal a denied excluded drug denial request?

Yes. All appeals can be mailed or faxed to the following:

CVS Caremark Prescription Claim Appeals MC109

P.O. Box 52071

Phoenix, AZ 85072-2071

Fax 1-866-443-1172

Enrollment changes can only be made during Open Enrollment or within 30 days of a Qualifying Life Event (QLE). Qualifying life event includes:

- Marriage/ Divorce

- Birth/ Adoption/ Guardianship

- Gain/ Loss of other insurance coverage

- Change in Medicaid or SCHIP eligibility

- Death

To make an election change following a life event, employees must enter their events and upload the necessary documentation directly through Employee Self Service within 30 days of the event. If you miss the 30 day window you will need to wait until open enrollment to make an election change. All qualifying events must be supported by a proof of the event and, when adding dependents, proof of the relationship. These instructions speak to the most prevalent Life Qualifying Events. For a complete description of Life Qualifying Events relative to our plan, review the Plan Document.

A change in coverage elections due to a birth, adoption or placement for adoption will be effective as of the date of the birth, adoption or placement for adoption. All other changes in coverage elections will be effective as of the first day of the month following the date the change in election application (including supporting documentation) is received by the Plan Administrator.

See instructions for submitting a life event.

Important Note: If the life event is related to a death, please contact the Benefits Office at benefits.office@fcps.org for assistance in making the necessary election changes as these events will not be in employee self-service.

| Life Event | Documentation to Submit with enrollment/change form | Days to submit |

| Marriage | Marriage certificate | 30 days from marriage |

| Divorce | Official divorce decree to remove spouse | 30 days from official divorce |

| Birth |

Submit enrollment form within 30 days of birth. Birth Certificate and Social Security Number can be submitted once they are received. Do not delay submitting the enrollment form as this is due within 30 days of birth. |

30 days from birth |

| Adoption/ Guardianship | Official court document | 30 days from official adoption/guardianship date |

| Gain other coverage | Official proof of gain of other coverage to include all names of those covered, type of coverage, and effective date | 30 days from gain of other coverage |

| Loss of coverage | Official proof of loss of coverage to include all names of those covered, type of coverage, and effective date. When adding dependents to coverage, proof of relationship is required | 30 days from loss of other coverage |

| Change in Medicaid or SCHIP eligibility | Official notice of change in eligibility | 60 days from change of eligibility |

| Death |

Death certificate *Do not delay submitting the enrollment/change form as this is due within 30 days of death; you may submit the Death Certificate when received. |

30 days from death |

Leave

Overview of Leave

As a part of FCPS’s commitment to the staff experience, we are pleased to offer various forms and types of time off as a benefit. The following outlines policies and procedures as it relates to the use of accrued leave and requesting extended leave from work. Be sure to check your Negotiated Agreement for a complete listing of all leave types.

Leave designated under the Family Medical Leave Act (FMLA) offers unpaid, job protected leave for eligible employees who experience their own serious health condition, or need to care for an eligible family member with a serious health condition.

Medical documentation should be submitted if your absence will extend beyond 3 days. You may view your eligibility, rights and responsibilities via the Employee Rights Under the Family Medical Leave Act. Additional protections under FMLA include medical benefits remaining at the active rate. To receive pay during leave, you will use your accrued leave, or other paid leave resource.

Benefited employees who do not qualify for leave under FMLA may be eligible under our Personal Disability program.

FMLA Documents – Forms should be sent to the Benefits Office

- Certification of Health Care Provider - Employee

- Certification of Health Care Provider - Family Member

- Checklist for Leave

More detailed information about FMLA can be found under Regulation 300-42.

FCPS offers employees an opportunity to take unpaid time off work for a variety of reasons, including health related, parental, and personal, etc. The employee remains employed by FCPS, however, does not have an active job assignment.

This option is unpaid, and typically lasts until the end of the fiscal year. The employee is able to continue health insurance at the full cost as outlined below. The employee is billed for any continued coverage by the FCPS finance department. Payments are due at the first of each month and coverage may be canceled due to non-payment/late payment. Review your Negotiated Agreement for additional information on a leave of absence.

*As a reminder, if you retire from FPCS while on a leave of absence you may only choose to continue the insurance benefits you have in place at the time of your retirement.*

Returning from an LOA

Upon confirmation that you are returning for the following fiscal year, you will receive communication regarding a work assignment. It is the employee’s responsibility to notify the Director of Human Resources no later than March 1 of their plans to return for the following fiscal year and/or to remain on leave for an additional year. Please see the negotiated agreements for additional information on Leaves of Absence.

How to request an LOA

To request an LOA, you must submit a Status Change Form to Human Resources. For health- related leave requests, please contact the Benefits Office.

Pension Information

The MD State Retirement Agency considers certain types of LOA’s qualifying leave for pension service. An approved leave may allow you to purchase the time at a later date.

Be sure to speak with a Retirement Coordinator prior to your planned LOA to complete Form 46 if your reason for leave is included in the qualifying absences recognized by the MSRA.

It is the employees responsibility to ensure that all proper paperwork is completed for submission to the MSRA for your time off on a qualified Leave of Absence.

Leave of Absence Insurance Rates FY 2025

| LOA | Medical | Dental Standard | Dental Buy UP |

|---|---|---|---|

| Employee Only | $976.92 | $28.82 | $39.64 |

| +1 Dependent | $2,129.70 | $89.36 | $122.92 |

| Family | $2,246.92 | $98.88 | $135.98 |

|

Life Insurance: $0.108 per $1000 per Month (ie. 100,000/1000 * .108 = $10.80 per month) Life Insurance is your annual salary, rounded to the nearest thousand x 2 |

|||

FCPS provides certain military family leave entitlements. Eligible employees may take FMLA leave for specified reasons related to certain military deployments of their family members. Also see the FCPS Military FMLA Policy 300-47 for details.

FCPS provides for time off when an employee has a baby, adoption, or a foster placement, in compliance with the FMLA Law and FCPS Regulation 300-42. If you do not qualify for FMLA, you may be eligible for Personal Disability Leave as detailed in the Negotiated agreement.

To Qualify

In order to qualify for FMLA, you must be employed with FCPS for more than 1 year, and have worked 0.5 or greater of your position in the year preceeding the leave. For those who do not qualify for FMLA, FCPS offers Personal Disability leave for the time period when the employee is medically unable to work.

What to Do

When preparing for this absence, please provide the appropriate documentation:

- Projected Leave Form which shares your intent for leave duration and provides employee information to assist in determining if you qualify for FMLA

- Submit Certification of Health Care Provider for the Employee or Family Member if you will be medically incapacitated or if your spouse will be medically incapacitated and you will provide care. If you are requesting leave due to the birth, adoption or foster placement of a child, please provide proof of birth, adoption or placement.

- Be certain to share your plans with your Administrator and complete proper leave reporting procedures such as completing a Leave Request Form.

- Review this checklist for informational and action items during your time off. If you have questions regarding any of the items listed, contact Benefits.FMLA@fcps.org.

Getting Paid

FMLA is a federal law that allows you to take leave, paid or unpaid, for the birth or adoption of a child. In addition to leave for pregnancy, a parent is eligible for up to 12 weeks of leave that includes time for bonding with your child. The federal FMLA regulation allows for both parents to share the 12 weeks of bonding leave if they work for the same company, however, FCPS allows both parents to take a total of 12 weeks of leave during the first 12 months of the child’s life or placement in your home in cases of adoption. In order to be paid during this time, you will use your available sick, personal, and vacation leave. In addition, if you and your spouse both work for FCPS, one parent may donate sick leave to the other parent to use during the 12 weeks of pregnancy/bonding leave. Please review the language in the FCTA negotiated agreement: Article XXIV, H, 5 and 6. You must submit the Bonding Leave Donation Form to donate leave to your spouse. You may also consult with your affiliated Union to see if there are more pay options for you. Contact your Association (FCTA 301-662-9077, FASSE 301-620-9217, FCASA) for information.

Check your available sick, personal, and vacation leave in employee Self Service.

Returning to Work

For those who give birth to the child, you will need to provide the doctor’s medical release after the 6-8 week recovery period. A sample Return to Work Evaluation is available but you may use another source as a return to work note. This note should be submitted to the Benefits Office.

Insurance Enrollment/Beneficiary Changes

The birth or adoption of your child is considered a Qualifying Event, making you eligible for benefit changes. You have 30 days from the date of this event to make changes. Please review the information under Life Events tab. When submitting an enrollment form, please follow up (don’t delay submitting the enrollment form) with a copy of the birth certificate or completion of an attestation form. This information can be sent to Benefits.Office@fcps.org.

Special Considerations

Working until delivery

The employee is expected to work until delivery unless medically unable, at which time a physician would need to complete a separate Certification of Health Care Provider form. This form should indicate the medical reason for an absence prior to delivery.

Calculating the FMLA period

To calculate the FMLA period, a week is counted as a week of FMLA leave regardless of the work schedule. The only exception is if the school system temporarily closes for a solid week, the days the school system's activities have ceased do not count against the employee's FMLA leave entitlement. You will receive the dates of approved FMLA from the Benefits office.

Additional health benefits for you

Breast pumps will be covered under the Durable Medical Equipment (DME) benefit for FCPS active employees. If you use one of the in-network vendors, it will be paid at 100%. If using an out of network vendor, it will be paid at 80% of eligible expenses after the $200 deductible. National Ancillary DME breast pump providers will ship the breast pump directly to the member. Members can order breast pumps no more than 30 days in advance of delivery. Please refer to www.carefirst.com/frederick or call 1-866-386-2043 or contact a breast pump supplier on this list. Please be advised that network providers are subject to change.

FirstHelp - free 24-hour nurse advise line

Call 800-535-9700 anytime to speak with a registered nurse. Nurses can provide you with medical advice and recommend the most appropriate care.

Benefited employees who are not eligible for FMLA, may qualify for leave through Personal Disability Leave for their own serious health condition. This program works similar to FMLA in that it is unpaid, job protection, and insurance premiums remain at the active rate. To receive pay during leave, you will use your accrued leave, or other paid leave resource. See the Negotiated Agreement for additional details.

Personal Disability Leave Documents – Forms should be sent to the Benefits Office.

At the conclusion of your approved leave for health related reasons, you will need to provide medical documentation indicating you are cleared to return with or without restrictions. A sample Return to Work Evaluation is available but you may use another source as a return to work note.

To plan for your return, please provide at least 24 hours’ notice of your return. If your return is contingent upon restrictions, FCPS makes every effort to provide reasonable accommodations through the interactive process.

To plan time off work, complete and submit a leave request form to your supervisor. You may obtain this form through Form Finder at InsideFCPS, or from your work location. If your time off is unexpected, please communicate the nature of your emergency to your supervisor as soon as you can.

Vacation leave must be approved by your supervisor. Please see your Negotiated Agreement for vacation leave accruals.

| Personal Leave | Accrual/Year | Maximum Accrual | |

|---|---|---|---|

| 10 mo/7 hr | 21 hours | 1.05 per pay | 12 days |

| 11 mo/7 hr | 21 hours | 0.95 per pay | 12 days |

| 12 mo/7 hrs | 21 hours | 0.88 per pay | 12 days |

| 10 mo/8 hrs | 24 hours | 1.20 per pay | 12 days |

| 12 mo/8 hrs | 24 hours | 1.0 per pay | 12 days |

| Sick Leave | Accrual/Year | Maximum Accrual | |

|---|---|---|---|

| 0.5 | One day/month | 1.75 per pay | none |

| 7 hrs | One day/month | 3.5 per pay | none |

| 8 hrs | One day/month | 4.0 per pay | none |

Special Discounts and Deals on Products and Services

Special Discounts and Deals on Products and Services

Deals4U, an employee discount program especially for Frederick County Public Schools employees and retirees, provides online access to discounts and deals on products and services from national, regional and local merchants (for example: Target, Peapod, Regal Theatres, HP and more!). The Web-based program is administered by PerkSpot, a company that manages employee discount programs for a wide range of businesses and organizations across the country.

How it Works

- Create an online account at deals4u.perkspot.com using your personal (not work) e-mail address.

- Enter FCPS (if prompted for a code), and create and enter a password.

- You will receive confirmation and log-in instructions.

- After logging in, you have access to all the discount offers available to FCPS employees. (If you log in to Deals4U from your work computer, access to some vendors may be restricted for internet security reasons.)

Most merchants offer discounts for online purchases using a special link or code. Local merchants who are looking for walk-in, point-of-sale business may require presentation of coupons, flyers, and/or an FCPS Employee ID card in order to give the discount. In lieu of ID cards, non-benefited employees should show a recent FCPS pay stub or the annual “reasonable assurance of employment” postcard sent from Human Resources.

Get the Facts

Review the important guidelines for using Deals4U.

Do You Know a Local Merchant Who'd Be Perfect for Deals4U?

FCPS now uses Deals4U, powered by Perkspot, exclusively to communicate offers to employees. Questions? Go to https://www.perkspot.com/merchants/#contact

Additional wellness programs such as gym memberships and weight loss programs can be found under Wellness Partnerships.

FCPS employees, their spouses, and family members are eligible for Ferko membership. Visit the Ferko website for additional information on becoming a member.

MyFreeTaxes. This program is sponsored by United Way and H&R Block, (it's their software, the same software that others pay to use). The income limit to use this free software is $66,000 and people do their own taxes either on their computer or smartphone. There is also a 24/7 tax support to answer any questions that come up while doing your taxes, in English & in Spanish. Find more information at https://www.unitedway.org/myfreetaxes.

Volunteer Income Tax Assistance Program (VITA). With this program, clients come to one of our 3 locations and IRS-certified Tax Preparers do their taxes and e-file them for free. With this program, you do need to make an appointment and there is an income limit of $54,000.

Locations:

- Bernard Brown Community Center, 629 N Market St, Frederick

- Hillcrest Community Center, 1150 Orchard Terrace, Frederick

- Seton Center (only open for the first 6 weeks of tax season),16860 S Seton Ave, Emmitsburghttps://fcps.ezcommunicator.net/edu/Frederick/GetFile.aspx?DocId=14109

The phone number to make appointments is 2-1-1 (this works when called from Frederick County only) or 866-411-6803. United Way will open the line for appointments in early January and our appointments will start on February 1. H&R Block offers the online software for MyFreeTaxes only; the brick and mortar H&R Block locations do not offer free tax preparation.

guidanceresources.com

Web ID: FCPSMD

(800) 272-7255

For hearing impaired call (800) 697-0353

Summer Camp Information – Call ComPsych for further information and guidance

What is an Employee Assistance Program?

EAP provides you and your household members with free, confidential assistance to help with personal or professional problems that may interfere with work or family responsibilities. Historically thought of as only providing Mental Health services, EAP is now much more. You will find Legal advice, Childcare/Eldercare resources, Financial and much more in this resource.

The program is a FREE benefit provided and paid for by FCPS. If assistance is needed beyond the provided counseling visits, the GuidanceConsultant will assist you in finding a resource covered through your insurance.

How does it work?

Call your ComPsych GuidanceResources Program to connect directly with a GuidanceConsultant who will confidentially assess your concern/question, assist with any emergencies, and connect you to the appropriate resources. The GuidanceCounsultant then becomes your personal point of contact, keeping in touch to ensure you achieve your desired outcomes.

What is included?

- Confidential Emotional Support: You and your family member can speak with a highly trained clinician about any issues, including anxiety, depression, stress, grief, loss, life adjustments, relational and marital conflicts

- Work-Life Solutions: Specialists can provide qualified referrals and resources for just about anything on your to-do list, such as finding childcare, elder care, hiring movers, home repair contractors, planning events, locating pet care and services

- Legal Guidance: Speak to an attorney for practical assistance with your most pressing legal issues such as divorce, adoption, family law, will, trusts and more.

- Financial Resources: Financial experts can assist with a wide range of issues including retirement planning, taxes, relocation, mortgages, insurance, budgeting, debt management, bankruptcy and more.

- Online Support: GuidanceResources Online is your 24/7 link to vital information, tools, and support, such as articles, podcasts, videos, slideshows, on-demand trainings, and more.

- Interactive Digital Tools: A digital self-care platform, myStrength, offers interactive behavioral health tools and resources with guided programs on anxiety, chronic pain and opioids, depression, mindfulness, sleep, stress, substance use, and personalized resources on physical health conditions, and secure access through GuidanceResources Online.

Log on today to connect directly with a GuidanceConsultant about your issue or to consult articles, podcasts, videos and other helpful tools.

Links

- EAP Flier

- KOA 360 – New Virtual Opportunity – See New App Available (Enhanced Experience)

Video sharing KOA 360 offering and access directions - Stressed, Overwhelmed, Trouble Coping?

- Wallet Card

- GuidanceResources® Program *5 in-person sessions per issue, per year

- Summer Camp Planning

- Guidance Connect - flexible solution for accessing care

TSA Consulting Group

www.tsacg.com

TSACG customer service

888.796.3786 ext. 4

recordkeeping@tsacg.com

TSA Consulting Group is the Administrator for our plan. There are five (5) authorized approved vendors you may contact for enrollment assistance.

Most employees are eligible to participate in the 403(b) and/or 457(b) plan(s) upon hire. However, if you are a private contractor, trustee, school board member, and/or student worker, you are not eligible to participate in the 403(b) plan. If you participate in the retirement plan through FCPS, you are fully vested in your contributions and earnings at all times. You are eligible to contribute to either or both of the 403(b) and 457(b) plans. Contribution limits are as follows:

| 457(b) | 403(b) | |

| Contribution Limits: | $23,500 | $23,500 |

| Age Based Catch-up Option: | ||

|

♦ Age 50-59 or 64 or older by 12/31/2025 |

$7,500 | $7,500 |

|

♦ Age 60-63 on 12/31/2025 |

$11,250 | $11,250 |

| Special Catch-up Option: (contact Benefits Team for eligibility) | N/A | $3,000 |

Please see the 2025 Plan Comparison chart provided for more details.

The 403(b) is a retirement savings program for employees of public education employers. An employee can contribute money to their retirement savings via pre-tax or Roth contributions in the form of a payroll deduction.

The 457(b) is also for employees of public education where an employee can contribute money to a retirement savings account. Employees make pre-tax contributions in the form of payroll deductions.

Please refer to the 403(b)/457(b) Comparison Chart for clarification between the two plans.

- Contact one of the authorized agents.

- Use QuickENROLL to open a new 403(b) account online.

- Complete the Salary Reduction Agreement through TSACG (see also, Online Salary Reduction Agreement Overview)

- To open a new 457(b) account, please contact an authorized agent.

To increase or decrease payroll deductions, submit an electronic request through Online Salary Reduction Agreement. Deductions are entered as a percentage of your gross income.

Please allow at least one to two pay cycles for your request to become effective.

If you need to process a loan, hardship, distribution, rollover, or transfer from your 403(b) and/or 457(b) plan, go to TSA Online Distribution System to submit an electronic request. These documents must be sent to TSACG for processing. FCPS does not process or sign any documents. Please view the Information for Employees Advisors Letter for further information regarding the service TSACG provides on behalf of FCPS.

Toll-free: 1-800-492-5909

Local: 410-625-5555

TDD/TTY: 410-625-5535

http://www.sra.state.md.us/

FCPS participates with the Maryland State Retirement Pension system. Eligible active employees are required to contribute 7% of their pay to the pension plan. These funds are then contributed to your MSRA Pension Plan on your behalf as long as you are working for FCPS. You may update your beneficiary online by visiting the mySRPS section of the State Retirement Agency website.

Register for mySRPS to access below information online:

- Annual Personal Statement of Benefits (PSB)

- Obtain an Estimate of Benefits

- Participant Member Handbook

- Forms

The mySRPS system is able to provide retirement dates and an estimate for all pension payout options. Additional forms that you may need when nearing retirement are Form 26 and Form 43. Feel free to contact MSRA Member Services regarding questions completing these forms.

- MSRA Pre-Retirement Seminars

- MSRA News

- The Mentor, Summer 2024

FCPS Retirement Coordinators and Appointments

FCPS retirement coordinators can answer questions and assist you with preparing your retirement documents:

Retirement appointments are scheduled once per month and announced through Employee News. These small group appointments are usually held in the Central Office Board Room and are generally scheduled on non-student days to be more convenient for employees to attend. During these appointments, FCPS retirement benefits, Maryland State Retirement Agency forms and FCPS retirement forms are reviewed and discussed.

If you plan to retire, you should have your completed packet submitted to Human Resources no later than 30 days prior to your retirement date.

Upcoming Retirement Packet and Submission Meetings:

- Monday, July 21, 2025, 10 AM - Noon, Central Office

- Monday, August 11, 2025, 2 - 4 PM, Central Office

- Friday, September 26, 2025,2 - 4 PM, Central Office

- Friday, October 17, 2025, 2 - 4 PM, Learning & Leadership Center

- Thursday, November 6, 2025, 2 - 4 PM, Central Office

- Tuesday, December 2, 2025, 2 - 4 PM, Central Office

- Tuesday, January 20, 2026, 2 - 4 PM, Central Office

- Friday, February 13, 2026, 2 - 4 PM, Central Office

- Thursday, March 12, 2026, 10 AM - Noon, Central Office

- Monday, March 30, 2026, 2 - 4 PM, Central Office

- Thursday, April 9, 2026, 10 AM - Noon, Central Office

- Thursday, April 23, 2026, 5 - 7 PM, Central Office

- Friday, May 1, 2026, 2 - 4 PM, Central Office

Retirement Insurance Tier Eligibility (RITE)

To be eligible for benefits into retirement, you must have elected and had benefits in place, the fiscal year prior to your retirement date.

Example: Retirement date is October 1, 2025. Benefits must be in place during the 2024-2025 Plan Year. You cannot elect benefits during Open Enrollment with an effective date of July 1, 2025 and carry forth your elections into retirement. *This does not include enrollment during the year as it relates to a Life Qualifying Event. If you have questions, please contact a Benefit Team Member.

Nearing Retirement Eligibility:

- Request an MSRA estimate by mail using Form 9 or generate an immediate estimate by using the mySRPS login. The mySRPS system is able to provide retirement dates and an estimate for all pension payout options.

- FCPS offers eligible retirees with medical/vision coverage through CareFirst and dental coverage through Delta Dental.

- To be eligible for retiree benefits, you must have worked for FCPS immediately prior to your retirement and have a total of 10 (ten) years of service. You are then eligible to continue the coverage you held as an active employee.

- If you elect FCPS medical coverage upon retirement, once you meet the criteria below you are required to enroll in Medicare Part A and B. Submit a copy of your Medicare card to FCPS Benefits Office.

- when you and/or your dependent attain age 65

- if you and/or your dependent are 65 at the time of retirement

- if you or your dependent are under 65, but receiving social security disability, you may be required to enroll in Medicare

- As a retiree covered under the FCPS medical plans, your prescription drug plan is included in your coverage. If enrolled in Medicare, you will be enrolled in the SilverScript CVS Plan, if in the non-Medicare group, you will be enrolled in the CVS CareMark Plan. The coverage offered through Silver Script is considered creditable coverage, meaning it is at least as good as the coverage offered through Medicare Part D.

- FCPS offers group life insurance as a part of your retirement package.

- The coverage is equal to your final yearly salary, capped at $50,000.

- FCPS pays for the first $25,000 of your coverage. If you choose the maximum coverage allowed (over $25,000), see the rate chart below.

FY25 Retiree Life Rate Chart

Additional Pre-Retirement Planning Seminars and Webinars

Maryland State Retirement Agency (MSRA) Retirement Webinars

Pre-Retirement Webinar

These webinars provide a general overview of MSRPS benefits - including a general description of retirement eligibility and benefits provided by the MSRPS. Registration

First Steps Webinar

Our Retirement Readiness First Steps webinar provides a general overview of the survivor, disability, and retirement benefits administered by Maryland State Retirement and Pension System (MSRPS) – including descriptions of service retirement eligibility rules, vesting criteria, and ways to obtain additional qualifying service credit. This retirement readiness presentation is designed for early career and mid-career members of the Employees’ and Teachers’ Retirement and Pension Systems. Registration

Local Pre-Retirement Planning Seminars and Webinars

Pre-Retirement Planning training events are currently being offered both as in-person seminars and as webinars. The same topics will be covered in both formats.

To register, go to: http://www.ccbcmd.edu/ceed-preretirement-county

Webinar Dates and Course Numbers:

- May 29 & 30 (CRN 77265)

- June 7 (CRN 77205)

- June 26 (CRN 77209)

Onsite Seminar Dates and Course Numbers:

- June 20 – CCBC Catonsville (CRN 76956)

- June 25 – Harford Community College (CRN 77203)

FCPS believes in work/life balance, and strives to provide its employees with a variety of health and wellbeing options through the Strategic Plan, Aspirational Goal 5.

Events

While each school may have custom tailored wellness offerings, FCPS offers system-wide events. Each school has a Wellness Champion, who organizes and communicates the FCPS Wellness efforts. Follow us on Facebook for tips and updates.

2024-2025 Fitness Offerings

| 2 Health Nuts Fitness Classes, Winter/Spring (January - May) | |||

|---|---|---|---|

| Yoga Class | Mondays | 4:30 | Parkway Elementary |

| Zumba | Tuesdays | 4:30 | Parkway Elementary |

| Spin/Cycling | Wednesdays | 4:30 | LifeCYCLE |

| Yoga | Wednesdays | 4:00 | Thurmont Middle (note: new start time) |

| Drums Alive | Thursdays | 4:30 | Parkway Elementary |

|

Yogamour: Contact benefits.wellness@fcps.org for registration information Golf: The golf league is slated to begin on April 9, 2025, if interested in registering, please email benefits.wellness@fcps.org. Pickleball: The pickleball league will continue on Monday evenings, if interested in registering, please email benefits.wellness@fcps.org. |

|||

| Email benefits.wellness@fcps.org for more information. | |||

Community Partnerships

FCPS works diligently to cultivate connections with the community to provide the most to you. Some of our current partnerships provide you with discounted services. Check out the Wellness Partnerships tab below for more details.

Local Membership Partnerships

Local Membership Partnerships

- Air Doctor HVAC

- Anytime Fitness

- Bowerhouse MMA

- Club Pilates (last updated, 2/13/25)

- Fit2Shine Studio

- LifeCYCLE Studio (last updated, 1/10/24)

- Maximum Fitness

- MOD Nutrition

- Onelife Fitness (both locations) (last updated, 11/24/24)

- Orangetheory Fitness

- Pediatric Dental Center of Frederick

- Players Fitness & Performance

- Smile Frederick Orthodontics

- Soldierfit

- Sol Yoga

- T-Mobile Discounts

- Urbana Orthodontics (last updated, 9/23/24)

- YMCA

Additional Resources

Contact Course Approval

Click here to submit your coursework approval request.

All benefited FCPS employees are eligible for a tuition reimbursement benefit for coursework taken while employed with FCPS. Eligibility for reimbursement is based on the negotiated agreement with FCTA and FASSE. For specific information on programs and procedures for tuition reimbursement by unit, see Tuition Benefit Overview below.

All course requests require prior approval.

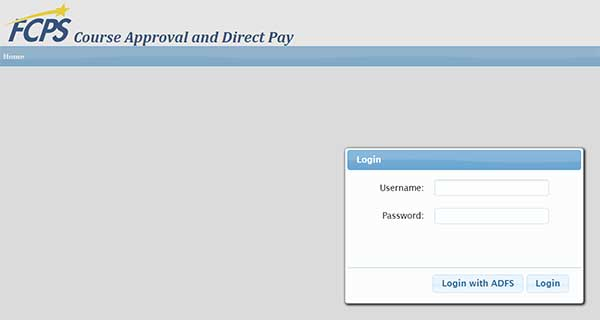

Step 1: Navigate to https://coursereg.fcps.org

Step 2: Log in using either your network login and password, or click “Login with ADFS.” See Fig. 1.

Figure 1: Login Screen

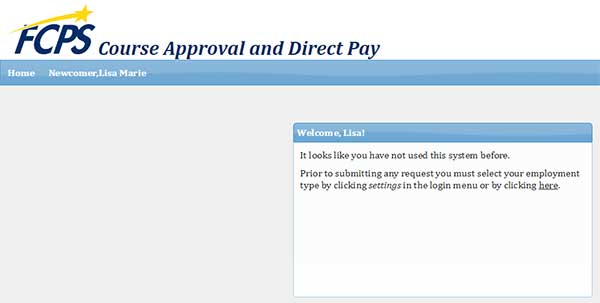

Step 3: If this is the first time you’ve visited the Course Approval site, you will be prompted to select your employment type (Certificated, Support, or AS/AMT). See Fig. 2.

Figure 2: Set Employment Type

Once you’ve set your employment type, you will be redirected to the main welcome screen. See Fig. 3.

NOTE: Should you need to change your employment type in the future, hover over your name on the blue menu bar and select "Settings" from the drop-down menu.

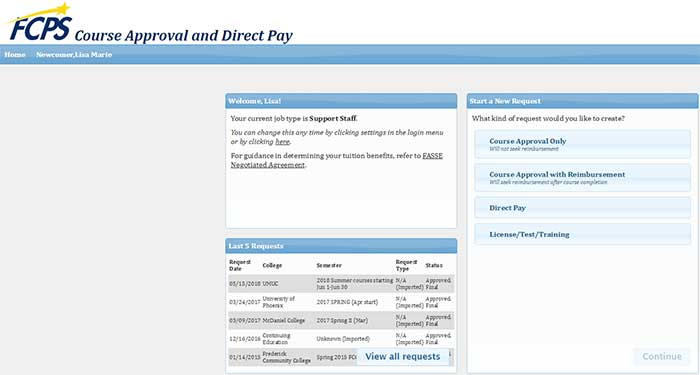

Step 4: To begin a new request, select the type of request you are entering from the “Start a New Request” box to the right and click “Continue.“ See Fig. 3.

Request types:

- Course Approval Only – Select if you are not requesting reimbursement.

- Course Approval with Reimbursement – Select if you’re seeking reimbursement, but you don’t wish to participate in the Direct Pay program (or you are attending a non-participatory school).

- Direct Pay – Select if you wish to participate in the Direct Pay program, FCPS will pay for its portion of your tuition assistance directly to the school.

- License/Test/Training – Select if you are testing for Praxis or other industry certification, or specialized training.

Please review the appropriate document for your job category below for a summary of your tuition reimbursement benefits:

NOTE: From this welcome screen, you can review previously submitted requests and begin a new request.

Figure 3: Welcome Screen with Summary

Continue here for Course Approval and Direct Pay requests. See Step 9 below if you are requesting approval for a license, test or training course.

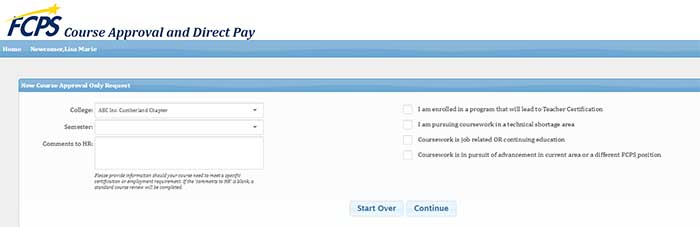

Step 5: The screens for the first 3 options are nearly identical. After selecting the college you are attending, the semester drop-down list will populate with your available semester choices. Enter any comments to HR. If you are requesting reimbursement through the Direct Pay program, enter your Student ID assigned by the college, if available. See Fig. 4. If you are a support employee, you will also have a series of checkboxes available to the right, select the one(s) that fit your situation. Click “Continue.”

Figure 4: College and Semester Selection

Step 6: The following screen adds a section that allows you to enter your course(s). Here you can enter multiple courses, one at a time. Click the “Add Course” button. See Fig. 5.

Figure 5: Add a Course

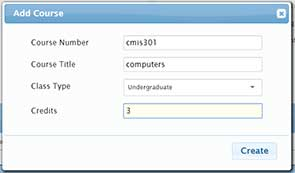

Step 7: When the “Add Course” screen appears, enter the requested information and click “Create.” Do this for every course you are requesting, if more than one. Your courses will be listed in the second table at the bottom of the screen as you create them. See Fig. 6.

Figure 6: Course Details

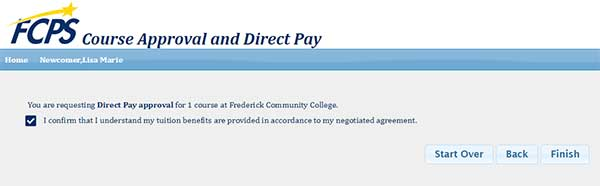

Step 8: Once you have entered all of your courses, click the “Continue” button. Here you will finalize your request. You must check the check box indicating that you understand the tuition benefits provided to you in the appropriate negotiated agreement. Click “Finish” to submit your request and return to the main summary screen. See Fig. 7.

Figure 7: Confirmation and Final Submission

Continue here for License/Test/Training Requests

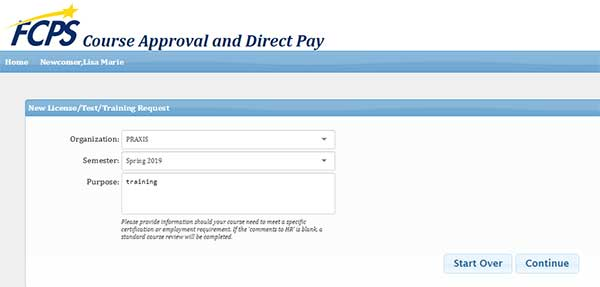

Step 9: Select your organization or request type and semester, describe the purpose of the request, then click “Continue.” See Fig. 8.

Figure 8: License/Test/Training Request Information

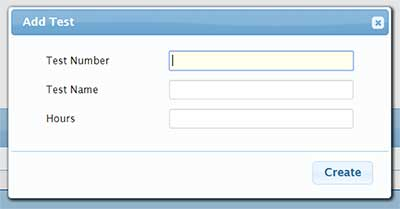

Step 10: Next you will be prompted to enter the details of your test/certification/training request. Click “Add Test,” enter your information and click create. See Fig. 9. As with a course approval/direct pay request, you can enter multiple items on your request, provided they all fall in the same semester timeline.

Figure 9: License/Test/Training Request Detail

Step 11: After entering all of the tests and/or training for which you are requesting approval, click “Continue.” Here you will finalize your request. You must check the check box indicating that you understand the tuition benefits provided to you in the appropriate negotiated agreement. Click “Finish” to submit your request and return to the main summary screen. See Fig. 7 above.

What’s next in the process?

- You will receive a CONFIRMATION email that your request was successfully submitted for review.

- Once your request has been reviewed and a decision made, you will receive another email informing you whether your request was approved or denied.

- If your request was approved:

- You may now enroll in the approved course(s)

- Save the approval email for your records.

- If your request was denied:

- You may resubmit a different course approval request OR

- If you need assistance or recommendations, you may contact courseapproval@fcps.org and we will be happy to provide you with some alternatives.

- If your request was approved:

How to submit for tuition reimbursement

To initiate the reimbursement, it is your responsibility to submit the following documentation, within 30 days of course completion:

- Itemized Receipt - Uploaded to your course request (directions below)

- The receipt will need to: verify your student account and the college, identify course and semester tuition charge(s), course/semester fee(s), and show a zero balance (shows course and fees have been paid-in-full).

- Directions to upload your receipt:

- Log into the course approval system

- Click on "View all requests"

- Click on the course you are seeking reimbursement for

- Click on "Attach Files"

- Attach the receipt

- The system will notify our team that a receipt has been uploaded

- Official Transcript - we can accept an electronic transcript OR an official paper transcript

- Electronic Official Transcripts - Must be submitted directly to courseapproval@fcps.org.

- The college and/or transcript provider will email us with a link and passcode to verify and download your transcript.

- We cannot accept forwarded or attached transcripts.

- Paper/Mailed Official Transcripts - Must be on the college official transcript paper.

- You may bring the transcript to our central office location OR

- You may have the college mail the transcript to our office, please use the below address:

- Electronic Official Transcripts - Must be submitted directly to courseapproval@fcps.org.

Human Resources - Course Approval

Frederick County Public Schools

191 South East Street

Frederick, MD 21701

Our team will process your reimbursement once ALL requested and appropriate documentation have been provided.

You must submit your Direct Pay or Tuition Reimbursement request no later than midnight on the deadline date. No exceptions will be made for late submissions.

| Direct Pay Partners | |

|---|---|

|

*Bowie State University *specific programs only |

Mount Saint Mary's College Trinity Washington University University of Maryland Global Campus (UMGC) University of Phoenix Walden University |

| Approval Windows for Direct Pay and Tuition Reimbursement | ||

|---|---|---|

| Summer Coursework | Fall Coursework | Spring Coursework |

| March 15 - July 1 | July 1 - October 15 | October 15 - March 15 |

|

All requests should be submitted 30 days prior to the course start date. (Article XXIII: Reimbursement for Education Expenses, Section A) |

||

| Reimbursement Submission Dates | ||

|---|---|---|

| Article XXIII: Reimbursement for Education Expenses, Section C | ||

| Classes Ending By | Reimbursement Submission Deadline | |

| Summer Coursework | August 31 | October 15 |

| Fall Coursework | December 31 | March 1 |

| Spring Coursework | June 1 | June 30 |

We have expanded our direct pay partnerships for ALL benefited staff. See table below for participating partners. With direct pay, you won’t have to pay up front and then wait for reimbursement! See Direct Pay & Tuition Reimbursement Deadlines listed above.

|

Participating College |

Eligible Employee Groups |

|---|---|

| Bowie State (Doctoral Program in Educational Leadership only) | Support, Certificated, AS, AMT |

|

Frederick Community College |

Support staff ONLY |

|

Frostburg State University (including the Hagerstown campus) |

Support, Certificated, AS, AMT |

|

Hood College |

Support, Certificated, AS, AMT |

| Loyola University of Maryland | Support, Certificated, AS, AMT |

|

McDaniel |

Support, Certificated, AS, AMT |

|

Mount St Mary’s |

Support, Certificated, AS, AMT |

| Trinity Washington University | Support, Certificated, AS, AMT |

| University of Maryland Global Campus (UMGC) | Support, Certificated, AS, AMT |

|

University of Phoenix |

Support, Certificated, AS, AMT |

|

Walden University |

Support, Certificated, AS, AMT |

To participate:

You must be a benefited employee with tuition benefits available to you.

You must complete the direct pay approval form online by the direct pay deadline AND before you register for courses.

Courses that are longer than a traditional semester (i.e. admin internships and yearlong courses) are not eligible for direct pay.

How it works:

- You must sign up online for direct pay for each semester and course.

- There is a deadline for direct pay signup. See Direct Pay & Reimbursement Deadlines. If you miss the deadline, you may still use tuition reimbursement.

- HR evaluates your request. You will receive an email notification indicating whether your request has been approved or denied. If approved, the email will also indicate the amount FCPS will pay to the college.

Once approval is received, you can enroll in your course(s).

- FCPS Human Resources Department will notify the college of your participation. The college will adjust your bill accordingly.

- The college will bill you directly for any non-eligible expenses (tuition in excess of your benefit amount or availability, fees, etc.). You are responsible for making timely payment to the college for these non-eligible expenses.

- At the end of the semester, the college will bill FCPS and release transcripts to FCPS for participants.

FCPS will then pay the college eligible expenses and update your professional education.

NOTE: Direct Pay benefits count against your overall tuition benefit allotment for the fiscal year, and are treated the same as a tuition reimbursement.

Click here if you would like to request approval to participate in the Direct Pay program.

- Loan Forgiveness Opportunities at Federal Student Aid

- Janet L Hoffman Loan Assistance Repayment Program (LARP) for MD residents

The Board of Education of Frederick County and the recognized employee bargaining groups (FCTA, FASSE, and FCASA) jointly reserve the right to modify or amend, in whole or in part, any or all plan provisions at any time.

Employees can find complete details in the company and plan legal documents, which will always govern in case of a dispute.

Note: Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness Program (TLFP) forms and inquiries should be sent to verifications@fcps.org.

Direct Pay Partnerships

FCPS has partnership arrangements with:

- Bowie State University State (Doctoral Program in Educational Leadership Only)

- Frederick Community College (Support only)

- Frostburg State University

- Hood College

- Loyola University of Maryland (M.Ed. in Educational Leadership and Post Master’s Certificate in Administration and Supervision Programs Only)

- McDaniel College

- Mount St. Mary's University

- Trinity Washington University

- University of Maryland Global Campus (UMGC)

- University of Phoenix

- Walden University

If your college or university is not a participating direct pay partner, you will receive instructions on how to request tuition reimbursement when you receive approval for your coursework.

For employees enrolled in coursework at our partner schools, FCPS will be billed tuition directly by the partner school. Employees must receive approval to participate before enrolling in coursework and will be billed only for non-eligible fees or expenses, or tuition in excess of the employees tuition benefit.

|

Plan/Contact |

Address |

Phone & Website |

|---|---|---|

|

Health/Vision Insurance |

||

|

CareFirst Medical |

CareFirst Administrator |

Phone: 1-866-386-2043 |

|

CareFirst Vision |

CareFirst Administrator |

Phone: 1-866-386-2043 |

|

Dental Insurance |

||

|

Delta Dental |

One Delta Drive |

|

|

Flexible Spending Accounts |

||

|

WEX |

PO Box 2926 Fargo, ND 58108-2926 |

Phone: (866) 451-3399 |

|

Prescription Plan |

||

|

CVS/CareMark Claims Office |

P.O. Box 52010 |

Phone: 1-866-260-4646 |

|

CVS/CareMark Mail Order |

P.O. Box 94467 |

Fax: 1-800-323-0161 |

|

Voluntary Products - Life and Short Term Disability |

||

|

MetLife |

200 Park Avenue New York, NY 10166 |

Phone 1-855-229-7306 |

Contact Information: Benefits

Benefit Contact Information240-586-8040 ( Main phone) |

|

|---|---|

|

Benefits Staff |

Responsibilities |

|

|

|

Nunzia Sulmonte Administrative Secretary (240) 586-8002 |

|

|

|

|

|

Kimberly Huff |

|

|

|

|

|

|

|

|

|

|